4th June 2021

According to a recently published report – UK Staycations 2021: A Year of Opportunities – from commercial property specialist, Colliers, lockdown-weary Britons unable to holiday abroad are treating themselves with luxury ‘staycations’ that could bring a £22 billion boost to domestic tourism. Marc Finney, head of Hotels & Resorts Consulting at Colliers, said: “Our research […]

Read more...

20th May 2021

Lewis & Co recently celebrated our 35th anniversary and, since 1997, has been based in the centre of Southborough. As we look back on our history, our research led us to discover that ‘our Southborough’ isn’t the only one! In fact, there’s a New England town called Southborough in Worcester County, Massachusetts, around 30 miles […]

Read more...

30th April 2021

This month Lewis & Co – which was founded by Barney Lewis – celebrates its 35th anniversary. Barney built a firm which prides itself on being personable, friendly and approachable, and it is a culture which Managing Director Gary Cornwell, who joined the firm in 2003, continues to this day. While still a teenager at […]

Read more...

26th March 2021

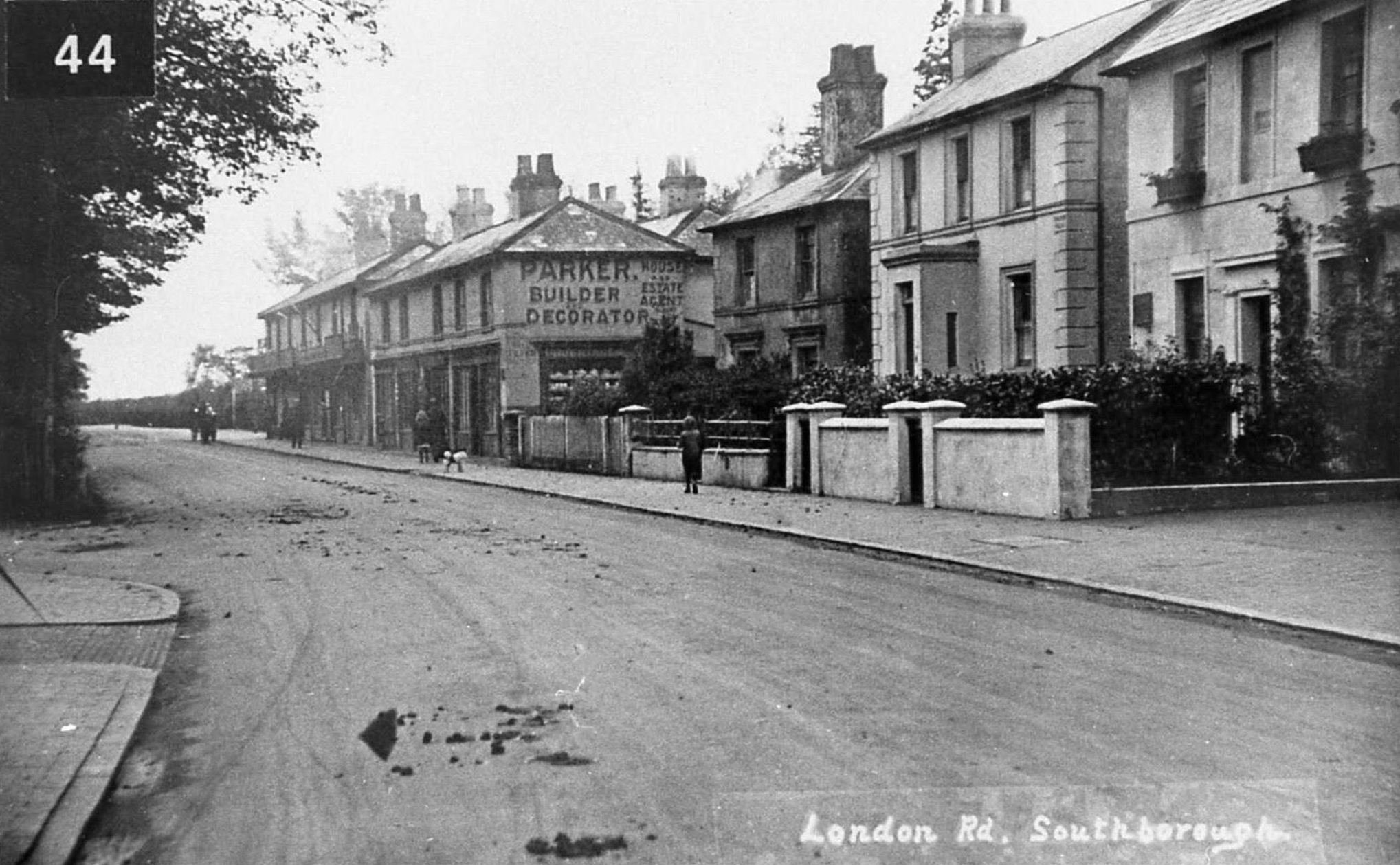

Lewis & Co has been based in the same building in the centre of Southborough in Kent for many years now. We know it was previously a home but we wanted to find out more, so we contacted the Southborough Society to see if it had more information. The Southborough Society exists to ‘stimulate interest […]

Read more...

11th March 2021

When launching a business, there are a number of questions which entrepreneurs typically ask. In addition to whether they should be a sole trader or a limited company, whether or not to register for VAT is a common query. The amount of VAT a business pays or claims back from HMRC is usually the difference […]

Read more...

26th February 2021

Adam Bailey joined the team at Lewis & Co on 9 April 2018. He had previously been working as a bookkeeper for a cleaning company, where he was introduced to the basics of online accounting using software such as QuickBooks and Xero. Adam admits that he had no idea what he wanted to do when […]

Read more...

12th February 2021

Happy Valentine’s Day! We hope you enjoy as romantic a day as you can in the midst of lockdown number three. If you’re not already married, then 14 February might make you think about popping the question. The good news is, if you do, then you could be on your way to saving some tax […]

Read more...

5th February 2021

Now February is here, you might think that, as accountants, we would be putting our feet up and relaxing after all of your self-assessment tax returns have been completed and filed with HMRC. That’s not the case. In fact, we have some really important work to do in this month… minimising your future tax bills. […]

Read more...

8th January 2021

Following the announcement of another nationwide lockdown, the Chancellor, Rishi Sunak, has unveiled £4.6 billion in new lockdown grants, including a one-off grant worth up to £9000 for businesses operating in the retail, hospitality and leisure sectors. This follows the Prime Minister’s announcement that these types of business will be closed until at least February […]

Read more...